Let’s start with an awkward confession: I used to believe that the key to getting rich was working longer hours—until I realized I’d been lining someone else’s pockets. What changed my mind wasn’t a financial guru or a spreadsheet, but a beat-up VW Golf with an engine more temperamental than a toddler. That car, and the financial chaos it unleashed, forced me to see money differently. If you’re tired of the monthly rat race and itching for a strategy that actually makes sense—without the pretentious jargon—you’re in the right place. Here’s what I wish I’d known sooner about owning your path to wealth and why a four-number formula could do more for your future than any job promotion ever will.

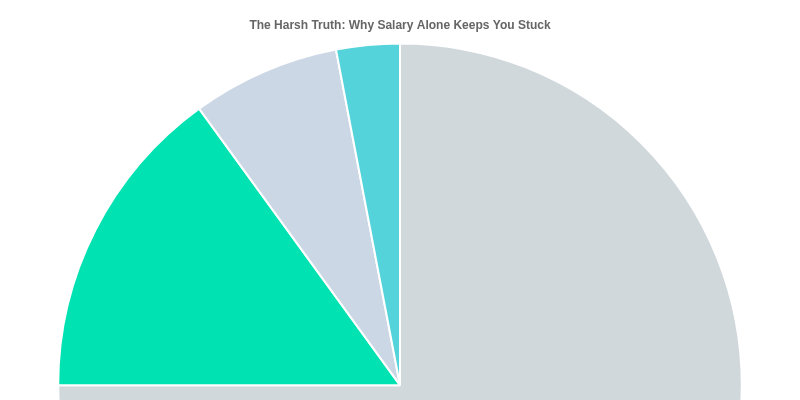

The Harsh Truth: Why Salary Alone Keeps You Stuck

When it comes to wealth management, most people believe that working hard at a good job is the path to financial freedom. But the reality is much harsher—and much simpler. If you look at the world’s richest individuals, almost none of them got there by simply earning a salary. The data is clear and eye-opening:

- 75% are entrepreneurs

- 15% are investors

- 7% are inheritors of wealth

- 3% are athletes, entertainers, or artists

- 0% are employees who just earn a salary

This breakdown tells you everything you need to know about building real wealth. The secret? Ownership. The world’s wealthiest people either own businesses, own assets, inherit trusts, or possess rare, highly valued skills. If you’re not in one of these categories, you’re not on the fast track to financial independence. In fact, you’re likely stuck in a cycle where your time is traded for money, and your money is spent on bills and expenses.

If you don't own something you are what's owned. That's the secret most people miss.

Why Employees Stay Stuck

Being an employee means you are paid for your time and effort, but you don’t own the results of your work. Your salary may cover your needs, but it rarely creates lasting wealth. Here’s why:

- No Ownership: Employees don’t own the company, the product, or the intellectual property. They are paid for their labor, not for the value they help create.

- No Leverage: Your income is limited by your hours and your employer’s willingness to pay. There’s a ceiling on how much you can earn, no matter how hard you work.

- No Passive Income: If you stop working, your income stops. There’s no asset generating money for you in the background.

This is why wealth management entrepreneurs and investors focus on acquiring or creating assets—things that make money even when they’re not actively working. They use financial strategies that multiply their wealth, not just maintain it.

Ownership: The Common Thread Among the Wealthy

Let’s look at what the top 1% have in common:

- Entrepreneurs own businesses that generate profits and grow in value.

- Investors own stocks, real estate, or other assets that pay dividends or appreciate over time.

- Inheritors own trusts or estates passed down through generations.

- Athletes, entertainers, and artists own rare skills or intellectual property that command high value.

In every case, ownership is the foundation. The ultra-wealthy don’t just work for money—they make money work for them. That’s why the 25/15/50/10 financial strategy is designed to help you think and act like the 1%. It’s about building a portfolio of assets, not just collecting paychecks.

The Trap of the Paycheck

If you rely only on a salary, you’re always one step away from financial insecurity. Lose your job, and your income disappears. But when you own assets, you have multiple streams of income and a safety net that grows over time. This is the core of any effective financial strategy for lasting wealth.

Remember: Most of the world’s richest are entrepreneurs, investors, inheritors, or rare-skill owners—not salary employees. If you want to break out of the cycle, you need to shift from earning to owning. That’s the harsh truth—and the first step toward true wealth management.

Breaking Down the 25/15/50/10 Rule – A Skewed Guide for Real-World Budgets

The 25/15/50/10 financial strategy isn’t just another budgeting fad. It’s a practical, flexible framework designed to help you manage your money like the top 1%, no matter your income. Here’s how to break it down and apply it to your real-world finances—even if you need to fudge the numbers to fit your situation.

25% for Growth: Let Your Money Work for You

The first 25% of your income should go directly toward growth. This means investing in assets that increase in value over time—think stocks, real estate, or even skills that boost your earning power. This is not about “mindset growth” or self-help mantras. It’s about putting your money into things that will make you wealthier while you sleep.

Most people get paid, cover bills, and spend the rest on things they barely remember. That’s why 99% of people end up owning nothing of real value. The system is designed to keep you living paycheck to paycheck. But if you take that first 25% and invest it, you’re flipping the script. Your assets start working for you, building wealth in the background.

Consider the impact of compound growth on investments. Take Billy and Phil:

- Billy invests $200/month from age 20 for 40 years—that’s $96,000 invested, growing to $1,264,816 at a 10% average return.

- Phil waits until 30, invests $300/month for 30 years—$108,000 invested, but only grows to $678,146.

Even though Phil invested more per month, Billy’s early start let compounding do the heavy lifting. Small, consistent contributions trump big, late efforts every time.

15% for Stability: Build Your Financial Safety Net

Next, set aside 15% for stability. This is your emergency fund or buffer—money that keeps you in the game when life throws you a curveball. As I learned the hard way, “Most people don’t have a money problem. They have a stability problem.”

When my car broke down unexpectedly, I had no savings. I took out a loan, then another, and spiraled into debt. If I’d had a stability fund, I could’ve fixed the car and kept my job without financial disaster. If you only have a couple of months saved up, then you won’t be as bulletproof.

Financial Stability Fund Calculation

- List your core monthly expenses: rent, groceries, utilities, transport, essential services.

- Add them up—this is your monthly baseline.

- Multiply by 5. That’s your emergency fund target.

For example, if your baseline is $1,500/month, aim for a $7,500 buffer. Each month, put 15% of your income toward this goal. Store it somewhere safe, accessible within 24 hours, and risk-free—never in the stock market or crypto.

50% Essentials, 10% Lifestyle: The Real-World Split

The remaining 50% covers your budgeting essentials—housing, food, transport, and other must-haves. The last 10% is for luxuries and lifestyle choices. In reality, you might need to adjust these percentages based on your income or location. The key is to prioritize growth and stability first, then fit your essentials and luxuries around what’s left.

Remember, the 25/15/50/10 financial strategy is a guide, not a rigid rule. Adjust as needed, but keep your focus on building assets and protecting your progress. That’s how the rich get richer—and how you can, too.

Growth Assets for Everyone: Index Funds, Real Estate, and ‘Unstealable’ Skills

When you’re building wealth, the assets you choose matter just as much as how much you invest. The good news? You don’t need to be a financial expert or have a huge bank account to get started. By focusing on proven growth assets—like index funds, real estate investment strategies (including REITs), and high-income skills—you can create a strong foundation for your financial future. Here’s how you can make these work for you.

Start Simple: Investing in Index Funds (S&P 500, International ETFs)

For most people, investing in index funds is the safest and easiest way to grow wealth. Index funds let you buy a slice of the entire market, rather than trying to pick individual winners. For example, the S&P 500 index fund tracks the 500 largest U.S. companies, offering instant diversification. Over the last 100 years, the S&P 500 has delivered an average annual return of about 10%—a powerful compounding engine for your money.

- Zero expertise needed: No need to study charts or time the market. Just invest regularly and let your money grow.

- Global options: Consider international ETFs like iShares MSCI World UCITS ETF (IWDA) for broader exposure.

- Low fees: Index funds typically have much lower fees than actively managed funds.

Think of index funds as your financial autopilot. They spread risk and require almost no maintenance, making them an ideal starting point for nearly everyone.

Real Estate Investment Strategies: REITs and Beyond

Real estate has long been a favorite for building wealth, but not everyone can afford to buy property. That’s where REITs (Real Estate Investment Trusts) come in. REITs let you invest in real estate without needing a huge down payment or dealing with tenants. You simply buy shares in a REIT, and you’re effectively owning a small piece of a portfolio of properties.

- Accessibility: Start with as little as the price of a single share.

- Diversification: REITs often own many properties, spreading your risk.

- Passive income: Many REITs pay regular dividends, adding another income stream.

REITs democratize real estate investing for small investors, making it possible to benefit from property markets without the headaches of direct ownership.

High-Income Skills: The Most Accessible Form of Ownership

While financial assets are important, don’t overlook the power of high-income skills. As the saying goes:

Learning a skill that makes you money is hands down the fastest return on investment you'll ever see.

Skills like copywriting, coding, editing, or sales can dramatically boost your earning power. Unlike stocks or property, these skills are ‘unstealable’—no one can take them away from you. They give you the autonomy to earn, invest, and grow your wealth on your own terms.

- Immediate impact: Start earning more as soon as you master a skill.

- Flexible income: Use your skills for side gigs, freelancing, or to advance in your career.

Alternative Investments: Bitcoin, NFTs, and the Risks

It’s tempting to chase the excitement of alternative investments like Bitcoin, Ethereum, NFTs, gold, or even sneakers. These can deliver huge returns—but also come with high risk. Think of them as moonshots: fun to try, but never the foundation of your strategy.

- High volatility: Prices can swing wildly—sometimes overnight.

- Speculative: Only invest what you’re willing to lose.

Start with solid assets like index funds, REITs, and high-income skills. Once your foundation is strong, you can experiment with riskier bets if you choose.

Protecting Growth: Using Tax-Advantaged Accounts and Automating Your Investments

One of the biggest secrets to building real wealth isn’t just what you invest in—it’s how you invest. The right account can mean the difference between keeping your hard-earned gains or handing over thousands in unnecessary tax without even realizing it. Tax-advantaged investment accounts in the UK and US, like ISAs, Roth IRAs, and 401(k)s, are powerful tools that help you protect and accelerate your investment growth.

Tax Wrappers: Shielding Your Returns from Taxes

Tax wrappers are special accounts designed to help you keep more of your investment returns. In the UK, the Stocks and Shares ISA lets you invest up to £20,000 per year, and everything you earn inside is completely tax-free. That means no capital gains tax, no dividend tax—just pure growth. You can open an ISA on automated investment platforms like Trading 212 or Vanguard in minutes. Just make sure you select the Stocks and Shares ISA option when signing up.

If you’re working a regular job, don’t overlook your workplace pension. Typically, you contribute 5% of your salary, and your employer adds another 3%. That’s essentially free money, and the investments inside grow tax-free until you withdraw them in retirement.

In the US, the Roth IRA is a game-changer. You can contribute up to $7,000 per year if you’re under 50, using money you’ve already paid tax on. The magic? Every penny your investments earn grows completely tax-free. When you retire, you can withdraw your money—and all the growth—without paying a cent in tax. Even billionaires take advantage of this: Peter Thiel famously turned his Roth IRA into over $5 billion by investing in early-stage companies, letting his gains compound tax-free.

Don’t forget the 401(k)—the US equivalent of a pension. Contributions come straight from your paycheck before tax, and your investments grow without being taxed until you withdraw. If your employer offers a match, always take it. That’s free money you don’t want to leave on the table.

If you're doing it through the wrong kind of account you could be handing over thousands in unnecessary tax without even realizing it.

Automated Investing: Consistency Without the Stress

Once your tax-advantaged accounts are set up, the next step is to automate your investments. Platforms like Trading 212 and Vanguard make it easy to set up monthly transfers that go straight into your chosen funds or stocks. This approach removes the temptation to spend, keeps your investing on autopilot, and leverages dollar-cost averaging—buying more shares when prices are low and fewer when prices are high, which can smooth out returns over time.

- Automated investing builds wealth consistently, even if you forget or get busy.

- It removes emotional decision-making, which is often the biggest barrier to long-term growth.

- Platforms like Trading 212 and Vanguard let you invest in diversified portfolios with just a few clicks.

Don’t Just Deposit—Invest for Growth

A common mistake is to open a tax-advantaged account, deposit money, and then leave it sitting in cash. To truly benefit, you need to choose growth assets—like index funds, ETFs, or shares—inside your ISA, Roth IRA, or 401(k). That’s how your money compounds and grows over time, shielded from taxes and boosted by automation.

Tax-advantaged investment accounts in the UK and US, combined with automated investment platforms like Trading 212 and Vanguard, make it surprisingly simple to protect and grow your wealth. Don’t leave money on the table—use these tools to your advantage.

Financial Stability Fund: Bulletproofing Your Journey (with Some Anecdotal Honesty)

Let’s get real for a second: building wealth isn’t just about investing and watching your money grow. It’s about staying in the game when life throws you a curveball. That’s where your financial stability fund comes in—a safety net that keeps you from falling off track when the unexpected happens. I learned this the hard way, and I want to spare you the same pain.

When I was 18, I needed a car to get to work. With no savings, I did what most people do: I took out a loan and bought a used VW Golf. For a few months, I felt unstoppable—until the engine blew up. Suddenly, I was facing a huge repair bill, no backup cash, and the real risk of losing my job. So, I borrowed even more, and the debt spiral began. That car didn’t just break down; it broke my finances and set me back a whole year. If I’d had a stability fund—just 15% of my income set aside—I would have been in a completely different position. Most people don’t have a money problem; they have a stability problem. One unexpected bill, and everything unravels.

So, how do you bulletproof your journey? Start with a simple financial stability fund calculation. First, add up your monthly essentials: groceries, rent, utilities, transportation, and any must-have services (like your internet if you need it for work). This is your monthly baseline. For example, if your core expenses total $1,500, multiply that by five. Your target stability fund is $7,500. Each month, direct 15% of your income toward building this fund until you reach your goal. It might feel extreme, but when life hits—and it always does—you’ll be glad you did.

Now, where should you keep this money? Here’s where many people go wrong. Your emergency cash should never be invested in the stock market, crypto, or any other risky venture. As I always say,

Whatever you do and I mean whatever you do do not put your emergency fund into the stock market.When an emergency strikes, the market could be down, forcing you to sell at a loss. That’s the opposite of bulletproof.

Instead, store your stability fund in a high-yield savings account. This is the ideal vehicle: your money stays safe, it’s accessible within 24 hours, and it earns a bit of interest. Don’t lock it away in a long-term account or a certificate of deposit that penalizes you for early withdrawal. When things go wrong, you need speed, not a waiting period. Remember, a robust stability fund is non-negotiable—it keeps life’s disruptions from turning into financial catastrophes.

To sum it up: calculate your monthly essentials, multiply by five, and aim for that as your stability fund target. Store your emergency money in a high-yield savings account, not in the market or risky ventures. Make sure it’s accessible in 24 hours, carries zero risk, and earns at least a touch of interest. Skipping this step means risking your progress and potentially being forced to cash out investments at the worst possible time. The rich get richer not just by investing, but by protecting their journey. Bulletproof yours—your future self will thank you.